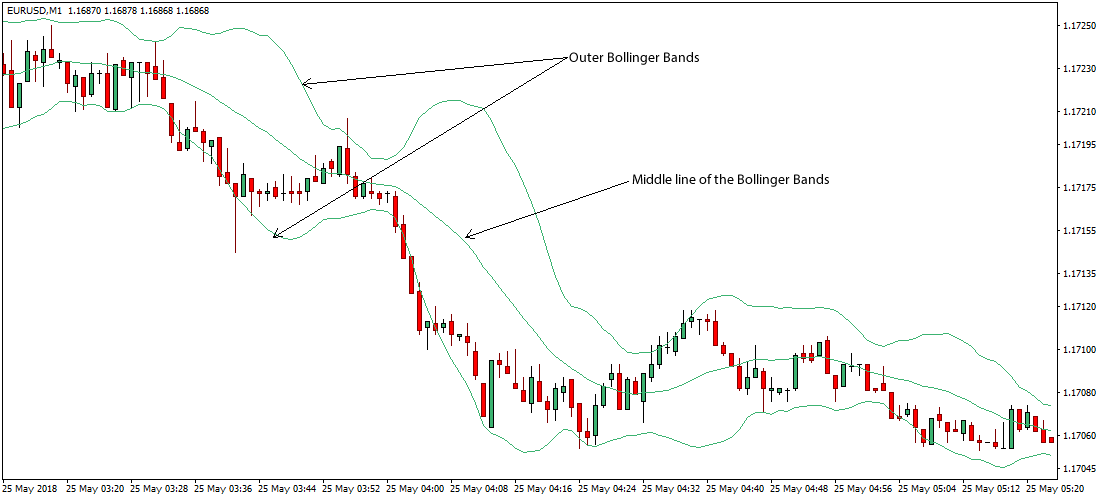

Yes, it is included in the national income by Income Method since it is a part of ‘wages in kind’ paid to employees. No, it will not be included in the national income as it does not amount to any flow of goods. The interest rate is the rate at which a borrower pays interest for the use of a lenders money. It is important to realize that the interest rate is the cost of obtaining money.

We have already considered this issue while deciding ground No. 4 of appeal filed by assessee. Following our view taken herein above we dismiss this ground raised by revenue. Ld.Sr.DR submitted that assessee had given interest-free loan of Rs.38.01 crores to M/s.

Examples of revenue expenditure are salaries of government employees, interest payment on loans taken by the government, pensions, subsidies, grants, rural development, education and health services, etc. In financial modeling and valuation, an analyst will build a DCF model to determine the net present value of the business. The most common approach is to calculate a company’s unlevered free cash flow and discount it back to the present using the weighted average cost of capital .

In accordance with GAAP, CapEx must be capitalized on a company’s balance sheet and recognized as an expense over the life of the asset. Ground no.7 raised by revenue pertains to deleting addition of Rs.28,07,055/- on account of prior period expenses. 38.Ground No.4 raised by revenue pertains to deleting of disallowance amounting to Rs.32,00,000/- paid as upfront fees. Ld.Sr.DR placed reliance on order of Ld.AO, however, he could not controvert submissions of Ld.Counsel. Ld.Counsel submitted that since no borrowed funds had been advanced to group companies, and total outstanding contained substantial element of brought forward balances.

Types of Capital Expenditures

On the contrary, Ld.Counsel contended that, identical payment was made in past assessment years, and has been allowed by Ld.AO himself in assessment made under section 143 of the Act. It was also pointed out that in certain assessment years disallowances made by Ld.AO has been deleted by Ld.CIT and revenue has either accepted the order, or appeal is pending before the Tribunal. That on the facts, circumstances and legal position of the case, the Ld.CIT has erred in law in upholding the disallowance of Rs.4,59,928/- on account of prior period expenses. The Government borrows from domestic as well as foreign sources. All borrowings are called capital debt receipts. However, interest paid on such borrowings is placed under Revenue expenditures.

- Firm incurred expenditure on medical treatment of employee’s family.

- Definitions of certain terms relevant to income from profits and gains of business or profession.

- Revenue expenditure refers to the expenditure that neither creates an asset nor reduces the liability of the government.

- Ground No.1 raised by revenue pertains to deleting addition of Rs.22 crores, made out of interest expenses.

- On the facts and circumstances of the case and law, the Ld.CIT has erred in deleting the addition of Rs.98,25,000/- made by treating 25% of royalty payment as capital expenditure.

- No, capital gains will not be included in the national income as they do not add to the current flow of goods and services in the economy.

For example, this includes salaries, interest payments, pensions, and administrative expenses. It is the expenditure by the government for the development of fixed assets. Accountants expense assets onto the income statement via depreciation. There is a wide range of depreciation methods that can be used (straight line, declining balance, etc.) based on the preference of the management team. If the interest rate change is applicable to prior periods, the business entity should record gain or loss of interest in the income statement.

Major repairs and replacement of plant which increase the efficiency of the plant. Loan repayment is the act of settling an amount borrowed from a lender along with the applicable interest amount. Generally, the repayment method includes a scheduled process in the form of equated monthly instalments or EMIs. Some person or financial institution takes monthly interest.

Is Repayment Of Loan A Capital Expenditure?

In the result this ground raised by revenue stands dismissed. On the contrary, Ld.Counsel submitted that on identical facts, Ld.CIT in preceding assessment years allowed claim of assessee. He placed reliance upon observations of Ld. Ground No.3 has been raised by revenue against deleting disallowance of Rs.78,56,810/- on account of development of existing products and prototype products. Respectfully following the same this ground raised by revenue stands dismissed.

The agreement takes place when the bank or another financial institution issues finance to the business entity or individual. A bank loan comprises principal amount and interest payment. Interest is a type of fee or compensation for borrowing money from lenders.

The company also listed as capital expenditures the purchase of solar energy systems for $32 million in 2021, $75 million in 2020, and $105 million in 2019. Below is an example of the cash flow statement for Tesla Inc. for years ending 2019, 2020, 2021, from the company’s annual report. On the facts and circumstances of the case and law, the Ld.CIT has erred in deleting the addition of Rs.98,25,000/- made by treating 25% of royalty payment as capital expenditure. The disallowance is accordingly deleted. The two remand reports of the Assessing Officer have also been taken into account in deciding the present ground along with the counter comments of the appellant.

However, share issue expenses and discount on issue of shares/debentures can be written off over a certain number of years. Expenditures incurred on office and administrative and selling and distribution departments in the normal course of business are revenue expenditures. These include salaries, rent, telephone expenses, electricity, postage, advertisement, travelling expenses, commission to salesmen.

It was a matter of record that all payments were made by account payee cheques and at least one party namely R.K. Ispat Ltd. was common to the preceding assessment year where the claim have been allowed. On the contrary Ld.Sr.DR submitted that assessee has made investments during year as per order of Ld.CIT which has yielded dividend income also. He submitted that it cannot be accepted that no expenditure could be attributable for earning of exempt income as section 14 A is triggered the moment there is exempt income earned during year by assessee. Further placing reliance upon decision of Hon’ble Supreme Court in the case of Maxopp Investment Ltd. vs CIT reported in 91 taxguru.in 154. Ld.Sr.DR submitted that strategic investments would also fall within the ambit of disallowance.

Whereas the interest paid before the commencement of the business is to be capitalised, however, if the same is after the commencement of the business the same is allowable as a revenue expenses. For the purpose, reliance is placed on Challapalli Sugar Limited’s case , Sivakami Mills’ case , Ritz Continental Hotels Ltd. v. Commissioner of Income-tax Central- II, Calcutta 114 ITR 554, Addl. V. Akkamba Testiles Ltd. 117 loan taken from bank is a capital expenditure ITR 294, Addl. V. Akkamamba Testiles Ltd. 227 ITR 464, Bombay Steam Navigation Co. Private Ltd. v. Commissioner of Income-tax, Bombay 56 Income Tax Reports 52, State of Madras v. G.J.Coelho 53 Income Tax Reports 186 and Commissioner of Income Tax v. Dalmia Cement Ltd. 242 Income Tax Reports 129. Revenue expenditure refers to the expenditure that neither creates assets nor reduces the liability of the government.

Which one is revenue expenditure interest on capital?

International or foreign companies may report their financial statements under International Financial Reporting Standards instead of Generally Accepted Accounting Principles . Be mindful of capitalization rule differences between the two codifications especially as it relates to IAS 16. On the facts and circumstances of the case and law, the Ld.CIThas erred in deleting the addition of Rs.22,00,00,000/- made out ofinterest expenses. Ground No.5 & 5 raised by revenue pertains to deleting of disallowance amounting to Rs.35,75,330/- on account of proto-type development.

Accounting and Journal Entry for Loan Taken From a Bank

This type of financial outlay is made by companies to increase the scope of their operations or add some future economic benefit to the operation. The capital might have been borrowed by an assessee for the purpose of business. This is in conformity with law and the accounting principles. Capex is important for companies to grow or maintain business by investing in new property, plant and equipment (PP&E), products, and technology. Financial analysts and investors pay close attention to a company’s capital expenditures, as they do not initially appear on the income statementbut can have a significant impact on cash flow. CapEx is important for companies to grow and maintain their business by investing in new property, plant, equipment (PP&E), products, and technology.

More Under Income Tax

However, if a business entity borrows money from banks or financial institutions, it is considered a bank loan. The loan is repaid to the lender in installments, and each installment consists of the principal amount & interest due. In the case of other debt items, the interest is paid at regular intervals, and the principal amount is paid to the debenture/bondholder on maturity. Bank loans are part of a larger debt & borrowings of the business entity. The debt and borrowing comprise of different items that include bonds, debenture, mortgages, financial leases, and bank loans.

Debt Financing and equity financing are considered under capital expenditure. The money was given by the government in the form of loans to states or repayment of its borrowings. Stand out and gain a competitive edge as a commercial banker, loan officer or credit analyst with advanced knowledge, real-world analysis skills, and career confidence.